A Curated Community of Climate Investors

Envest is a member-driven community accelerating capital into the future economy.

At our core, we’re here to foster member collaboration, derisk investments, and help accelerate investors’ path to conviction.

Kelci Zile

Managing Director

Invest, Connect, Grow

280+ Startups

Presented to members through

Envest programing.

Tens of Billions

Assets under management by

Envest members.

$8+ Billion

Current valuation of startups presented to Envest members.

Highly Curated

Members are selected by referral and mission alignment.

Active Investors

Members are actively deploying capital into solutions.

Collaborative Efforts

Our members show what's possible together.

Discover our programs that connect members, share insights, and foster growth.

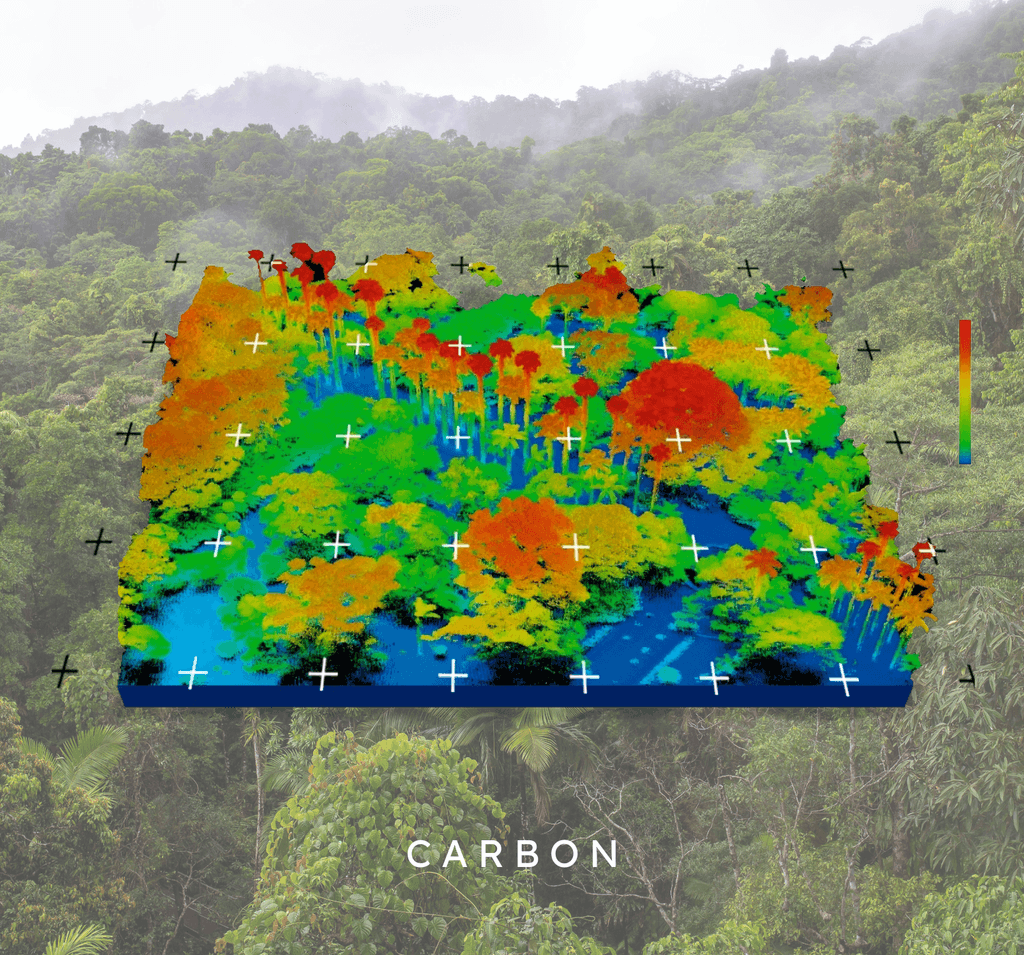

Envest has curated over 280 presenting companies in sectors like oceans, circular economy, built environment, and more, all aligned with a regenerative future. We help our members identify and invest in market-driven solutions driving economic and environmental returns.

Mission-aligned Investors

Our investors are chosen through referrals.

We collaborate and solve global challenges together.